Tax reimbursement on solar panels

Welcome to our dedicated page for Tax reimbursement on solar panels! Here, we have carefully selected a range of videos and relevant information about Tax reimbursement on solar panels, tailored to meet your interests and needs. Our services include high-quality Tax reimbursement on solar panels-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Tax reimbursement on solar panels. Explore and discover what we have to offer!

These enormous government incentives offer

Tax Day has arrived, which is good news for those expecting a refund — including taxpayers eligible for tax credits after installing solar panels. With refund season underway, experts are breaking down how these sizable

Read more

Homeowner''s Guide to the Federal Tax Credit for Solar

What is the federal solar tax credit? • The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic

Read more

Homeowner''s Guide to the Federal Tax Credit for Solar

What is a tax credit? A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal

Read more

Texas Solar Incentives and Rebates Guide

Its solar potential, in combination with its array of incentives, makes it easy for Texans to choose solar power for their properties. This guide explores solar incentives and rebates in Texas, including statewide programs, local initiatives,

Read more

Senate Approves Tax Credit for Acquisition and Installation of Solar

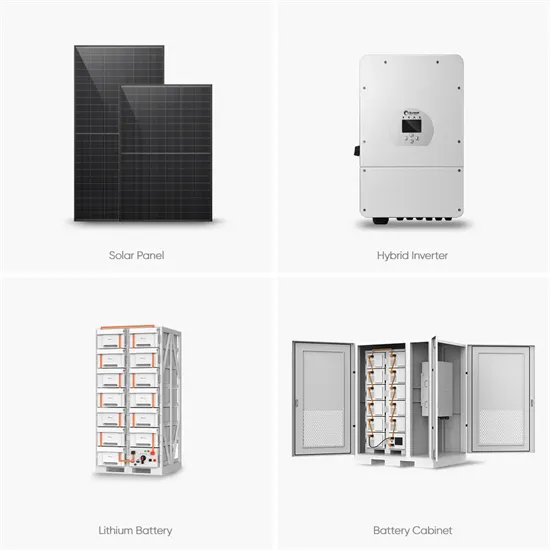

She said that the major components utilised in the installation of a solar photovoltaic system, such as the solar photovoltaic panels, solar inverters and solar batteries, including lithium-ion

Read more

Federal Solar Tax Credit: Take 30% Off Your Solar

Federal Solar Tax Credit If you want to power your home with solar, 2025 is likely the last year to claim a 30% federal tax credit for your investment in clean energy. In July 2025, Congress approved ending the 25D residential solar tax credit on

Read more

Income Tax Benefits for Solar-Powered Homes in

5. What is the maximum tax credit I can receive for energy-efficient home improvements? This varies greatly depending on the type and scale of installing solar panels or other renewable energy sources. The tax and

Read more

Federal Tax Credit for Residential Solar Energy

The credit for solar upgrades has been extended through 2034, empowering more homeowners to switch to solar. Find out if you qualify and learn how to claim the solar tax credit to recoup the cost of your solar installation.

Read more

Maximizing Tax Benefits with Solar Power Systems

As energy costs rise and sustainability becomes a global priority, solar power systems are gaining traction as a smart and eco-friendly investment. Beyond reducing electricity bills and promoting green living, solar

Read more

Everything You Need to Know – The 2024 Federal

Did you know that home solar panels, solar and storage systems and add-on batteries may be eligible for a 30% break? Learn how the federal solar tax credit works, how to qualify, what''s changed from years past

Read more

Frequently Asked Questions About the Solar Tax Credit

Today, with the cost of solar panels falling and the cost of grid electricity rising, the solar tax credit is more like the cherry on top of already substantial solar savings. It''s also the source of many questions, as most

Read more

Federal Solar Tax Credit: Everything You Should

The Residential Clean Energy Credit can make solar panels affordable by reducing the taxes you owe. Here''s how much the solar tax credit can save you, how to claim it, and what qualifies for savings.

Read more

Does the Solar Tax Credit Apply If I Get a Refund?

The solar tax credit, officially known as the Investment Tax Credit (ITC), is a valuable financial incentive for individuals and businesses investing in solar energy systems. With growing concerns about climate

Read more

How Nonprofits Can Now Qualify for Solar Tax Credits

The Inflation Reduction Act (IRA) of 2022 has revolutionized how nonprofit organizations can access solar energy benefits. Previously, nonprofits faced significant obstacles in leveraging solar tax credits due to their

Read moreFAQs 6

What is the federal solar tax credit?

The federal solar tax credit, formally known as the Residential Clean Energy Credit, is an incentive you can earn when installing solar panels or other clean energy equipment on your property. The tax credit equals 30% of installation costs and can reduce what you owe in federal income taxes by thousands of dollars.

Are solar panels tax deductible?

Roughly 37% of taxpayers are eligible. The Residential Clean Energy Credit allows you to claim a deduction for the cost of new clean energy property, including solar panels. The credit for solar upgrades has been extended through 2034, empowering more homeowners to switch to solar.

Can I claim a tax credit for a solar installation?

However, you may be surprised to learn that there is no maximum dollar amount that can be claimed as a tax credit for your solar installation! As long as you owe enough in federal taxes for the credit to cover, you can claim up to the full 30%, regardless of how large your solar power installation is. What does the federal solar tax credit cover?

Do solar panels qualify for tax credit?

Yes, you can claim the tax credit for solar installations on secondary residences. But check with your tax provider to determine if your vacation home meets the requirements to qualify. Does battery storage qualify for the federal tax credit in 2025?

Is the solar tax credit a refund?

Keep in mind that the federal solar tax credit isn’t a refund. And because it’s nonrefundable, if this credit reduces your overall tax bill below zero, don’t expect the IRS to send you a check for the difference. Because it's a credit instead of a reduction, the amount you're eligible for can be knocked off your taxes.

Are there income limits on the solar tax credit?

There are no income limits on the solar tax credit, so all individual taxpayers are eligible to claim the credit on qualifying solar energy equipment investments made to their homes within the United States.