Solar panels and vat

Welcome to our dedicated page for Solar panels and vat! Here, we have carefully selected a range of videos and relevant information about Solar panels and vat, tailored to meet your interests and needs. Our services include high-quality Solar panels and vat-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Solar panels and vat. Explore and discover what we have to offer!

Tax on shopping and services: VAT on energy-saving products

You''ll pay a rate of either 5% or 0% VAT when certain energy-saving products are installed in your home if you''re eligible. Not all products or installations qualify for the lower rate and you

Read more

EU prepares way for 0% VAT on several goods, solar

The European Council has approved a proposal to amend the EU rules on rates of value-added tax (VAT) to give member states more flexibility to set them. If adopted, solar panels for residential

Read more

0% VAT on Solar Panels and Heat Pumps (August 2025)

Chancellor Rishi Sunak announced cutting VAT from five per cent to zero upon installing energy-efficient systems such as solar panels, heat pumps and insulation. According to him, " A family having a solar panel

Read more

VAT For Renewable Installations UK | Impact Services

VAT Rates For Charities 0% VAT applies to the installation of the following energy savings materials in buildings intended for use solely for a relevant charitable purpose: Solar Panels (Roof and Ground) Battery Storage (Standalone or retro

Read more

A Comprehensive Guide to Zero-VAT for Domestic

Understanding the VAT treatment for the supply and installation of solar panels is essential for homeowners, businesses, and contractors alike. We hope this comprehensive guide serves as a valuable resource for

Read more

#All you need to know about VAT reduction for your installation in

Let''s briefly cover the most important points: What VAT is applied to the installation of solar panels for self-consumption? For most of the residential installations in Spain, the VAT currently is

Read more

Solar Panels and Heat Pumps installation reclaim

UK Solar Panels VAT Update: Zero Rate from April 2022 – What You Need to Know Starting April 2022, the VAT for solar panels and heat pumps in the UK has been reduced to 0%. This guide explains the VAT policies for

Read more

Tax on shopping and services: VAT on energy-saving

You''ll pay a rate of either 5% or 0% VAT when certain energy-saving products are installed in your home if you''re eligible. Not all products or installations qualify for the lower rate and you

Read more

Government Announces Zero VAT Rate for Solar Panels in

The Irish government has recently announced a major incentive for homeowners looking to install solar panels on their private dwellings. Effective May 1st, 2023, there will be a zero rate of VAT

Read more

VAT on Solar Panels Dropped Down to 0% Until 2027

There is currently no VAT on solar panels fitted on residential properties in England, Scotland, Wales and Northern Ireland. This was introduced in April 2022 and will remain in place until 31st March 2027.

Read more

Further changes to VAT on energy-saving materials

The more common ESM include controls for central heating, draught stripping, insulation, solar panels, ground- and air-source heat pumps, micro combined heat/power units and wood-fuelled boilers, and wind and

Read more

Understanding the New VAT Rules for Solar Panels in

Conclusion Installing solar panels is now more affordable than ever, thanks to the new VAT rules in the UK. The 0% VAT rate applies to all residential solar panel installations, even those that include a battery storage

Read moreFAQs 6

What is the VAT rate on solar panels?

The old VAT rate on solar panels was either 5% or 20%, depending on the situation. Installations would come with a 5% VAT rate if they were carried out at a household with a resident who was aged 60 or over or received a qualifying benefit.

Do I have to pay VAT on solar panels?

If you purchase solar panels from a retailer and have them installed by a different company, you’ll be charged a 20% VAT rate. However, most people switching to solar are unlikely to do this, and for good reason.

Do solar panels come with 0% VAT?

You can only get this 0% rate if you purchase your equipment from the same company that you use to install it. So if you buy solar panels from one company, then hire a different firm to install them, the installation will come with 0% VAT – but the original purchase won’t. And the 0% VAT rate doesn’t just apply to solar panels and batteries.

Will solar panels save VAT?

Chancellor Rishi Sunak announced cutting VAT from five per cent to zero upon installing energy-efficient systems such as solar panels, heat pumps and insulation. According to him, “ A family having a solar panel installed will see tax savings worth over £1,000 and savings on their energy bill of over £300 per year.

When will 0% VAT on solar panels come into effect in Northern Ireland?

It’s worth noting that in Northern Ireland, the 0% VAT rate on solar panels came into effect in May 2023, a year later than the rest of the UK, but it will end at the same time, in April 2027. Check out our page for more information on getting solar panels in Northern Ireland.

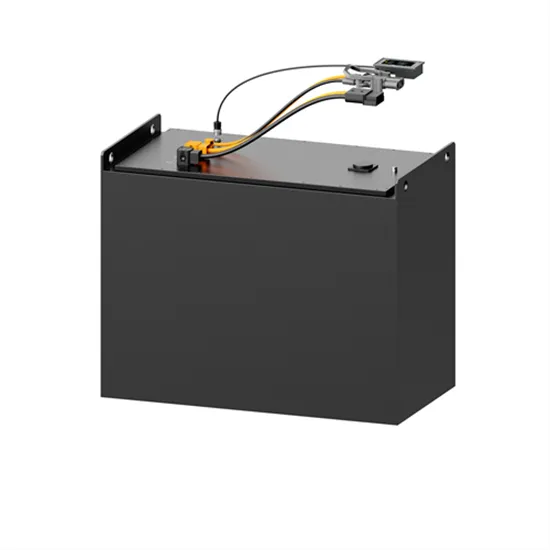

Do solar batteries qualify for 0% VAT?

Luckily, the government has now added solar batteries to their list of energy-saving products that qualify for 0% VAT, regardless of what they’re installed alongside of. Like solar panels, solar storage batteries can reduce both energy bills and carbon emissions by storing excess electricity produced from the panels, to be used later.