Vat on solar panels and batteries

Welcome to our dedicated page for Vat on solar panels and batteries! Here, we have carefully selected a range of videos and relevant information about Vat on solar panels and batteries, tailored to meet your interests and needs. Our services include high-quality Vat on solar panels and batteries-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Vat on solar panels and batteries. Explore and discover what we have to offer!

Further changes to VAT on energy-saving materials

The more common ESM include controls for central heating, draught stripping, insulation, solar panels, ground- and air-source heat pumps, micro combined heat/power units and wood-fuelled boilers, and wind and

Read more

UK Government Slashes VAT on Battery Storage

The decision to eliminate VAT on battery storage systems is particularly beneficial for users of solar PV systems. By making energy storage systems more affordable, homeowners and businesses can more effectively

Read more

VAT on Solar Panels Dropped Down to 0% Until 2027

Is the extra cost of VAT on solar panels a major reason that''s stopping you from making your home more energy-efficient? If the answer is yes, you may be pleasantly surprised to learn that since April 2022, VAT on energy

Read more

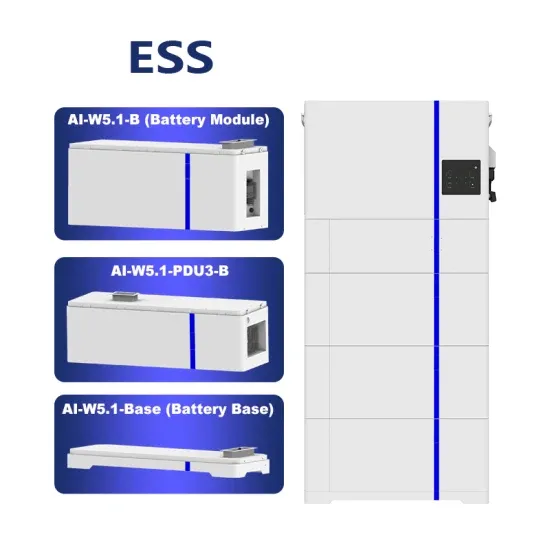

How Much Do Solar Storage Batteries Cost?

There has been 0% VAT on solar storage batteries, since February 2024, regardless of whether they are a standalone product or part of a solar panel system. This has helped bring down the price of solar storage

Read more

UK government extends VAT relief on battery storage

The move extends beyond previous VAT relief, which was limited to batteries installed alongside solar panels. The policy now includes standalone battery installations and retrofitted batteries as well.

Read more

VAT on Solar and Battery Storage

VAT on Solar and Battery Storage As part of the Spring Statement 2022, the Chancellor made the welcome announcement that from 1 April 2022 until 31 March 2027 VAT on installing energy-saving materials (ESMs) in residential

Read more

Understanding VAT On Solar Panels For Business

This includes VAT on solar panels, inverters, batteries, mounting hardware, and any related labour or consultancy services. Unlike residential properties, where recent government policy introduced zero VAT on solar panels for home use,

Read more

Does VAT apply to home batteries? | Duracell Energy

Any solar battery now purchased is under the new VAT rate and will be significantly cheaper. This change in VAT has reduced the price to the consumer, thus encouraging more households to invest in greener residential energy

Read more

Is there VAT on Solar Panels? | 0% VAT on Solar

VAT on Solar Panels in the UK There is currently 0% VAT on solar panel installations for residential properties in the UK. This 0% VAT rate applies to both the cost of solar panels and their installation, as well as to solar

Read more

Is there VAT on Solar Panels? | Lincs Renewables

As of the aforementioned date, the installation of solar panels and batteries for domestic use is now VAT-exempt. This exemption applies not only to the equipment itself but also encompasses the installation costs.

Read more

VAT For Renewable Installations UK | Impact Services

VAT Rates For Charities 0% VAT applies to the installation of the following energy savings materials in buildings intended for use solely for a relevant charitable purpose: Solar Panels (Roof and Ground) Battery Storage (Standalone or retro

Read more

Solar Panels and Heat Pumps installation reclaim

UK Solar Panels VAT Update: Zero Rate from April 2022 – What You Need to Know Starting April 2022, the VAT for solar panels and heat pumps in the UK has been reduced to 0%. This guide explains the VAT policies for

Read more

Further changes to VAT on energy-saving materials

But from 1 February 2024, the zero rate is extended to electrical battery storage that is retrofitted to a qualifying ESM. Also, installation of electrical battery storage as a standalone technology

Read more

0% Vat on batteries, for Solar PV. | Gasway Services Ltd

0% Vat on batteries, for Solar PV. 0% Vat on batteries and other renewable peripherals Starting February 1, 2024, the UK government will offer 0% VAT on hundreds of energy-saving products, including solar panels, battery

Read moreFAQs 6

Will the UK reduce VAT on battery storage systems?

In conclusion, the UK Government’s decision to reduce the VAT on battery storage systems to 0% from 1st February 2024 is a landmark move in the nation’s journey towards sustainable energy.

Do you pay VAT on solar batteries?

That means you still had to pay 20% VAT on solar batteries that were installed as a stand-alone product, or retrofitted onto an existing solar panel system. Luckily, the government has now added solar batteries to their list of energy-saving products that qualify for 0% VAT, regardless of what they’re installed alongside of.

Do solar batteries qualify for 0% VAT?

Luckily, the government has now added solar batteries to their list of energy-saving products that qualify for 0% VAT, regardless of what they’re installed alongside of. Like solar panels, solar storage batteries can reduce both energy bills and carbon emissions by storing excess electricity produced from the panels, to be used later.

What is the VAT rate on solar panels?

The 0% VAT rate on solar panels will last until the 1st of April 2027. After that, VAT on solar panels will increase to 5% – meaning it won’t go back to the 20% rate. You won’t need to meet the pre-April 2022 criteria to qualify for the reduced rate either. The 5% VAT rate will apply to solar panels being installed on any residential property.

Does VAT affect solar battery storage?

It is a necessity, not a luxury, and it is pleasing to see this reflected in the VAT status of solar batteries. Effectively, the reduction in VAT will decrease homeowners’ costs for energy installations, making them more affordable and financially efficient for the average household. When Will The VAT Exemption on Battery Storage Start?

What is the VAT exemption on solar panels & battery installations?

As of February 1, 2024, a significant change has illuminated the realm of sustainable energy in the UK—the VAT exemption on solar panel and battery installations. This transformative shift not only promotes the adoption of clean energy solutions, but also brings noteworthy financial benefits to both residential and commercial consumers.