Sales tax on solar panels

Welcome to our dedicated page for Sales tax on solar panels! Here, we have carefully selected a range of videos and relevant information about Sales tax on solar panels, tailored to meet your interests and needs. Our services include high-quality Sales tax on solar panels-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Sales tax on solar panels. Explore and discover what we have to offer!

Tax On Solar Panels Pakistan

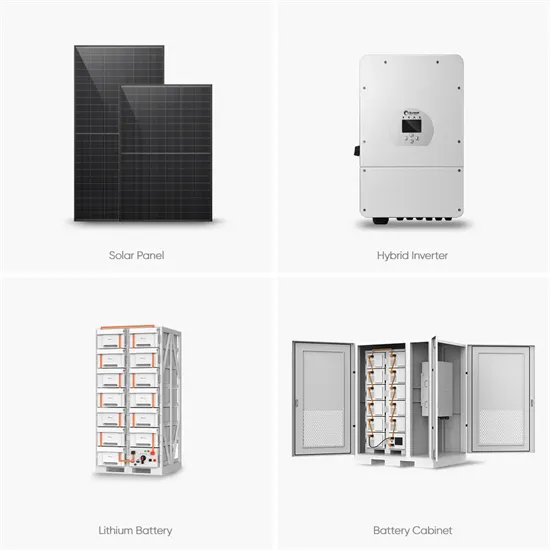

Tax On Solar Panels Pakistan? Government has introduced tax incentives for solar panels, not a tax. The federal government has exempted duties on the import of key components used to manufacture solar panels, inverters, and

Read more

Ohio Solar Incentives: Tax Credits & Rebates Guide

Solar power is an attractive option for Ohio homeowners who want to decrease their electric bills and embrace clean energy. However, the high up-front costs can be a significant hurdle. Fortunately, various incentives, tax

Read more

Solar panel taxes in Pakistan

FAQ''s What tax benefits are offered for solar panel installations in Pakistan? The government offers solar panel taxes in Pakistan, exemptions for importing solar panels, sales tax exemptions for purchases, and tax credits for businesses

Read more

A Guide to Ohio Tax Exemptions for Solar Panels

Sales Tax Exemption Depending on your location, you may be eligible for exemptions on the purchase of solar panels. To qualify for this exemption, the solar panel must be a "solar energy system," You must

Read more

Maximize Solar Savings with State Solar Sales Tax

Solar sales tax exemptions reduce the upfront costs of installing solar systems by eliminating state sales taxes. 25 states in the U.S. offer sales tax exemptions for solar energy equipment, making solar more

Read more

What are the benefits of sales tax exemptions for solar

Sales tax exemptions eliminate the state sales tax on purchasing solar energy systems and their components, significantly lowering the initial expense. For example, if a solar system costs $20,000 and the sales tax

Read more

STAR: State Automated Tax Research for the State of Texas

Solar Energy Devices – Sales and Installation Many Texans are making the switch to solar energy devices as a source of renewable energy for their residential or commercial buildings, which

Read more

2025 Iowa Solar Incentives & Tax Credits Guide — SolarReviews

Homeowners in Iowa who buy solar panels can save about $7,830 on their installation through solar incentives and the investment tax credit (ITC). Incentives make it easier on your wallet to

Read moreFAQs 6

Do you pay sales tax on solar energy?

Sales tax incentives typically provide an exemption from the state sales tax (or sales and use tax) for the purchase of a solar energy system. This type of exemption helps to reduce the upfront costs of a solar installation. There are 25 states that offer sales tax exemptions for solar energy.

Are solar panels exempt from sales tax?

Also, 17 states provide some form of sales tax exemption for solar energy equipment. Some sales tax exemptions include only solar panels, while others include everything but transformers and monitoring equipment, and still others exempt all related solar equipment.

Which states do not charge sales tax on solar panels?

Five states -- Alaska, Delaware, Montana, New Hampshire and Oregon -- don't charge any sales tax for any purchases. Similar to property tax exemptions, many states will require an application for the sales tax exemption on solar equipment. Which states exempt solar panels from property taxes and sales taxes?

Do solar panels increase property tax?

Solar panels may increase property tax or cost you hundreds of dollars in sales tax - unless your state offers solar tax exemptions. Here's what's out there.

What are solar tax exemptions?

Learn more Tax exemptions are solar tax incentives that can reduce either the upfront or long-term cost of adding solar panels to your home. Unlike income tax credits, you do not need to have income to claim these incentives. There are two types of tax exemptions available: solar sales tax exemptions and solar property tax exemptions.

Which states have solar sales tax exemptions?

In all, 34 states plus Puerto Rico and Washington, D.C., have property tax exemptions in effect, but they’re subject to change. For instance, in California, the property tax exemption on solar was recently extended from the end of 2024 to Jan. 1, 2027. What Are Solar Sales Tax Exemptions?